Retailing in India: SERVING A ‘NEW NORMAL MENU’

The Indian food service industry opens once again, prepared with a lot more choices of outlets, menus, consumption and higher levels of hygiene.

– by Surender Gnanaolivu

The India Food Services Report 2019 pegged its market size at $57.4 billion and forecasts it will grow to $81.32 billion by 2022 or 2023. Interestingly, the market is 20 times that of the famed film industry and five times that of the hotel industry.

The pandemic has disrupted this growth, however, impacting the livelihood of more than 7.3 million people employed in the restaurant and food industry. However, retail sector’s response has been a total reimagining of business and operating models in order to take advantage of the challenges and survive these trying times.

Shuttering, relocating, downsizing and focusing on carryout and online platforms have helped the industry float closer to the surface. Established offline and online food service players are leading the way in rebuilding consumer confidence by offering a safe experience across channels, including dine-in, take-out and online ordering.

Eating out

Government directives of 50 percent occupancy and limited staff and service hours are challenging walk-ins for à la carte ordering. Serious efforts to redesign systems at every step in food service operations then evangelize those improvements on social media are required to motivate walk-ins and indulgence.

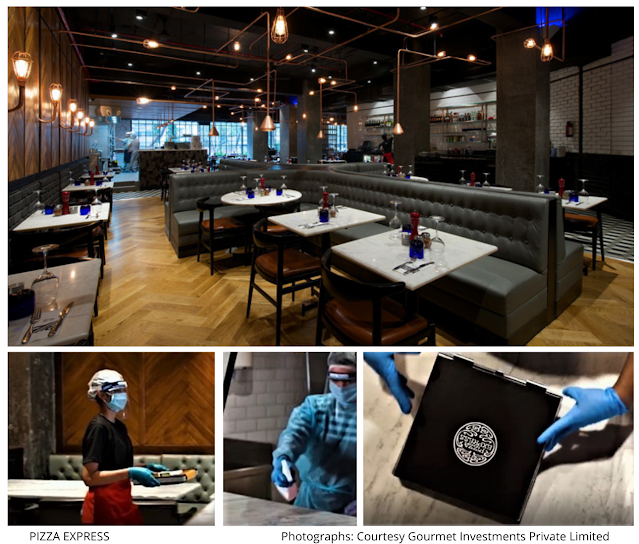

Popular global brand PizzaExpress, a part of Gourmet Investments Private Limited, has been successfully operating eight locations in India. The brand recently opened its doors in Delhi national capital region (NCR) and Mumbai in line with health and safety protocol guidelines designed by global health organizations and the local government to ensure the wellbeing of its staff and customers across its contactless delivery, take-out and dining services.

Customers, encouraged to make a reservation online, are required to announce their arrival at the host desk, be temperature screened, sanitize their hands and wear a mask before being escorted to their prebooked table. To maintain physical distancing, seating is reduced to half, the menu is digitized with QR codes and contactless online-payment-enabled links sent to the customer’s phone. Pizzaiolos, dressed in safety gear, serve freshly baked meals with sanitized disposable cutlery prepacked in environmentally friendly pouches.

Dining in

Driven by carryout and home delivery, restaurants in residential areas are doing 50 percent better than those in commercial areas. The complexity in logistics in this channel necessitates a lot more attention to maintaining end-to-end consistency in safety and hygiene for both restaurant takeaways and online app-powered delivery.

Chili’s, an American brand partnered by the same group across Western and Southern India, opened its carryout services with a tight contamination-proof system for food pickup. On arrival, customers or pickup service partners wait on physical distancing markings, have their temperature screened, contact details recorded and meet the “front guardian” at the door. Dressed in safety gear and connected to the kitchen via a remote communication device, he informs the “dispatcher” in the kitchen, who places the freshly made food parcel on the pickup counter at the door.

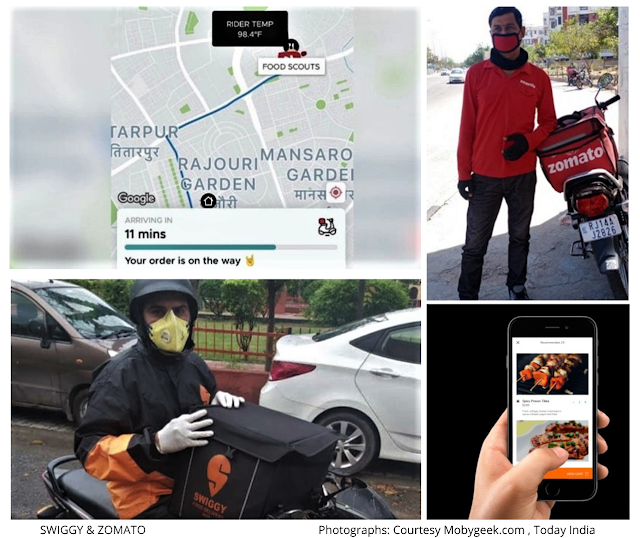

The Indian app-powered food delivery industry – used by more half-a-billion smartphones – is dominated by two giants, Swiggy and Zomato. Together they are estimated to have served more than 200 million customers from roughly 25,000 restaurant partners across 500 cities since the lockdown on March 25. Training their partners how to package, pick up, handle and deliver food in strict compliance with stipulated health and hygiene norms is helping the two brands earn customer confidence. Interestingly, insights from homebound consumers’ lifestyles have helped develop DIY meal kits and cocktail mixers delivered with a step-by-step guide to cooking a restaurant-style meal.

A recent study on Indian food delivery apps by Rakuten Insight reports that 79 percent of respondents would prefer to continue to order food online even after social distancing measures are lifted.

Cloud burst

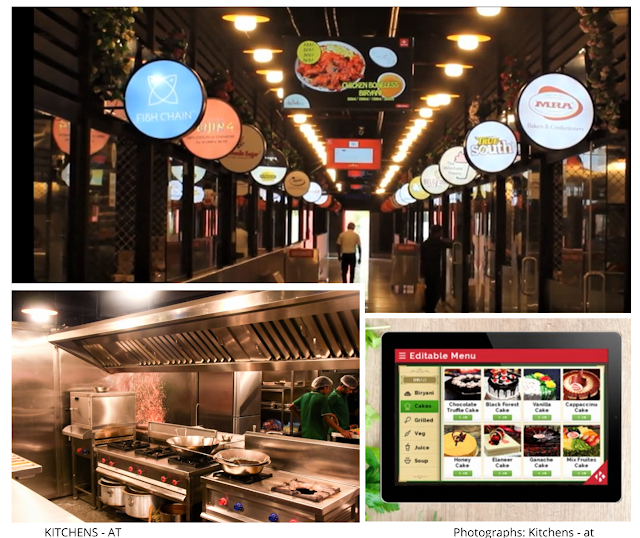

The concept of “cloud kitchens,” commercial kitchens that serve only online orders, have the acceptance of Indian consumers owing to their existence for decades in the form of tiffin or dabba (a lunchbox delivery service) offering hot meals for office-goers.

Today, the growth of this industry is being driven to an estimated five times its current numbers in the next five years by better suitability to physical distancing, setup costs of about $6500, low overheads as well as profit margins about 1.5 times of regular kitchens. According to RedSeer Management Consulting, cloud kitchens are estimated to become a $2 billion industry in India by 2024. This segment has shown a faster recovery evident in the achievement of 70 to 75 percent of pre-COVID sales and increase in the average order value by 50 to 60 percent.

Rebel Foods, India’s largest cloud kitchen chain valued at $1 billion, is a success story in this segment, operating more than 3000 internet restaurants and 320 cloud kitchens that serve a staggering two million orders a month. Classified as an essential service during the lockdown, the chain has served more than 300,000 meals to needy, stranded workers and low income customers to date.

Kitchens-at, an opportunistically innovative plug-and-play cloud kitchen hub, enables restaurants to hire ready kitchens at no investment or rent. Fourteen kitchen hubs host and manage about 366 cloud kitchens for national chains, popular city restaurants and food entrepreneurs designed for carryout only options and delivery managed on a tech-enabled platform. This format is becoming popular in today’s times of scarce capital and cash flows and encouraging more players like cinemas operators to enter the arena.

Conclusion

The National Restaurant Association of India predicts a likely 40 to 50 percent plunge in industry revenues in 2021 and the closure of about 30 percent of restaurants in India permanently. Hopefully, a steady rise in customer confidence and willingness to indulge in the food service industry, owing to the creation of more choices of outlets, menus and higher standards of hygiene, will help drive consumption and help the industry recover in the months to come.

Written exclusively for and edited by vmsd.com : https://www.vmsd.com/content/retailing-india-serving-new-normal-menu